Discover top passive income ideas that you are passionate about. Multiple passive income ideas from low investments to high investments are discussed in the video here.

(For your passive income dream to come true, start by investing as early as possible. Explore the multiple passive income streams from this video. (if video does not load on your browser, it is here).

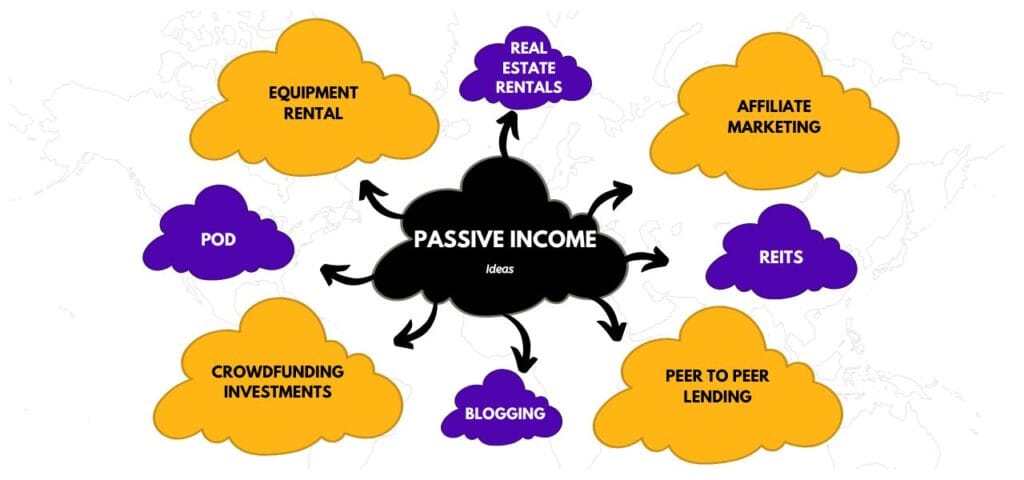

In today’s world, the concept of passive income ideas is drawing more attention than ever before. With the rise of digital entrepreneurship, remote work, and the increasing desire for flexibility and financial freedom, people from all walks of life are searching for ways to generate income streams that don’t require trading hours for dollars. But what exactly is passive income, how does it differ from traditional earnings, and how can you start building your own streams today? Let’s explore the fundamentals of passive income, its benefits, the most popular strategies, and how anyone can get started—whether you’re a student, a busy professional, or someone planning for retirement.

Passive income, at its core, is money earned with minimal ongoing labor after an initial investment of time, effort, or capital. Unlike a conventional nine-to-five job, where you receive a paycheck in direct exchange for your work, passive income allows you to earn while you sleep, travel, or focus on other projects. That doesn’t mean passive income is completely hands-off. Most passive income streams require some groundwork—setting up systems, building products, or investing capital up front. There’s also some degree of maintenance or oversight involved. But once established, the income keeps flowing with far less active involvement.

So, who stands to benefit from passive income? The answer is almost anyone. Aspiring entrepreneurs may use it to build wealth and free up time for new ventures. Professionals might want a side income to supplement their salaries or provide a safety net. Retirees and those planning ahead can use passive income to secure their golden years. Stay-at-home parents, digital nomads, and students often turn to passive income for added flexibility and freedom. The key requirement is having the discipline and patience to invest up front—whether that’s time, money, or expertise—in exchange for future rewards.

Let’s look at some real-world examples of passive income streams and how people are making them work. One of the oldest and most popular approaches is investing in rental properties. Here, you purchase real estate—like a house, apartment, or commercial space—and rent it out to tenants. The tenants’ rent payments provide ongoing income, while the property may appreciate in value over time. Of course, being a landlord comes with responsibilities, but many investors hire property managers to handle day-to-day issues, making it a mostly hands-off investment.

Another classic passive income strategy is investing in dividend-paying stocks. When you buy shares in companies that pay dividends, you receive regular payouts—typically quarterly—just for holding those shares. Over time, you can reinvest those dividends to accelerate your portfolio’s growth. It’s a tried-and-true method for building wealth with relatively little effort, especially for those willing to research and diversify their holdings.

In the digital age, opportunities for passive income have multiplied. Blogging is a great example. If you have expertise or passion in a particular area, you can create a blog and publish content that attracts visitors. Over time, you can monetize your blog through affiliate marketing, advertising, or selling digital products. While building a successful blog requires patience and consistent effort up front, it can eventually generate a steady stream of income with minimal ongoing work.

Affiliate marketing is another popular online strategy. Here, you promote other people’s products or services—usually through a website, blog, or social media—and earn a commission for every sale made through your unique referral link. The beauty of affiliate marketing is that you don’t need to create your own product or handle customer service. Once your content is live and ranking in search engines, it can continue to bring in commissions for months or even years.

Digital products, such as eBooks, online courses, or printables, are another way to generate passive income. Creating an eBook or designing an online course requires an upfront investment of time and expertise, but once it’s published, it can be sold an unlimited number of times with little additional effort. Platforms like Shopify, Amazon Kindle Direct Publishing, Udemy, and Etsy make it easier than ever to reach global audiences.

For those with a knack for design, print-on-demand services offer another powerful passive income stream. You create designs for t-shirts, mugs, phone cases, and other merchandise, upload them to a print-on-demand platform, and whenever someone buys your product, the platform handles manufacturing, shipping, and customer service. You collect the profits, while the heavy lifting is done for you.

Automated e-commerce, such as dropshipping, is another avenue. In a dropshipping business, you create an online store and sell products without ever stocking inventory. When a customer makes a purchase, the order is sent directly to the supplier, who ships the product on your behalf. With the right marketing and product selection, a dropshipping store can generate ongoing sales with minimal active management.

If you have capital but prefer not to manage physical properties, consider investing in Real Estate Investment Trusts, or REITs. These are companies that own and manage income-producing real estate. By purchasing shares in a REIT, you gain exposure to real estate markets and earn a share of the income generated—without the headaches of direct property management.

Peer-to-peer lending is an innovative approach to passive income. Online platforms connect lenders with borrowers, allowing you to lend out your money in exchange for interest payments. The process is typically automated, and your returns can be reinvested for compounding growth.

Even equipment rental can be a lucrative passive income source. If you own tools, cameras, vehicles, or other valuable equipment, platforms exist where you can rent them out when you’re not using them, generating income from assets that might otherwise sit idle.

Of course, with so many options, where should you begin? The best passive income stream for you depends on your skills, interests, and resources. Digital products and online content are often ideal for those with limited capital, while real estate and dividend investing are better suited for those with more money to invest. The initial investment required can range from almost zero—such as starting a blog or writing an eBook—to several thousand dollars or more for real estate or stock market ventures.

It’s important to recognize that while passive income sounds attractive, it’s not always easy. In fact, the journey to building successful streams can be challenging. Most sources rate the difficulty around six out of ten, and the historical success rate is moderate to low. Many people get discouraged by slow early progress or underestimate the time required to see returns. Consistency, patience, and a willingness to learn are essential. For most, it takes six to eighteen months or longer to see meaningful results.

So how can you increase your odds of success? Treat your passive income pursuit like a real business. Set clear goals and make a plan. If you’re starting an online venture, learn the basics of marketing and search engine optimization—great content alone isn’t enough to attract an audience. Start small and test your ideas before making large investments of time or money. Use analytics to track your progress and adjust your strategies as needed.

Investing in your own learning is often the best investment you can make. There are plenty of courses, books, and mentors available to help you avoid common pitfalls and accelerate your results. And remember, the power of passive income is in its compounding effects. Growth may be slow at first, but with persistence, your efforts can snowball into significant long-term rewards.

Above all, choose an approach that aligns with your interests and resources. If you enjoy writing or teaching, digital content may be a great fit. If you have capital and prefer a more hands-off investment, consider dividend stocks or REITs. The diversity of passive income opportunities means there’s something for everyone.

In summary, passive income offers a pathway to greater financial freedom, flexibility, and security. By investing time, money, or expertise up front, you can create ongoing income streams that reduce your dependence on traditional employment and give you more control over your life. Whether you’re just starting out or looking to expand your financial horizons, there’s never been a better time to explore the world of passive income. So take the first step—research your options, set your goals, and begin building the foundation for your future today. The journey may require patience, but the rewards can last a lifetime.